Why Traditional Reimbursement Is Crippling Business Efficiency

Every day delayed in processing reimbursements means losing an opportunity for capital turnover—research shows traditional reimbursement processes take an average of 3 to 5 days. For your business, this could mean hundreds of thousands of dollars tied up annually in paper receipts, unable to be used for operations or growth investments.

The root problem lies in inefficient manual procedures: employees spend hours filling out forms, paper documents get lost or delayed between departments, and approval chains span multiple layers of management—any bottleneck halts the entire process. According to the 2024 Asia-Pacific Financial Process Efficiency Report, over 60% of SMEs admit error rates in reimbursement reach as high as 15%, with repeated revisions and checks significantly increasing labor costs.

Manual form-filling and paper-based approvals lead to high error rates and tracking difficulties due to lack of real-time visibility. This is not just an administrative burden—it’s a silent chokehold on cash flow. Worse, employee frustration caused by cumbersome reimbursement procedures quietly erodes organizational satisfaction and productivity.

When processes rely on manual coordination, finance teams can only react to fires instead of proactively optimizing capital allocation. The turning point comes with adopting digital solutions that eliminate physical document transfer and enableone-click submission, automatic routing, and real-time tracking, making financial operations clear and controllable.

How DingTalk's One-Click Reimbursement Works

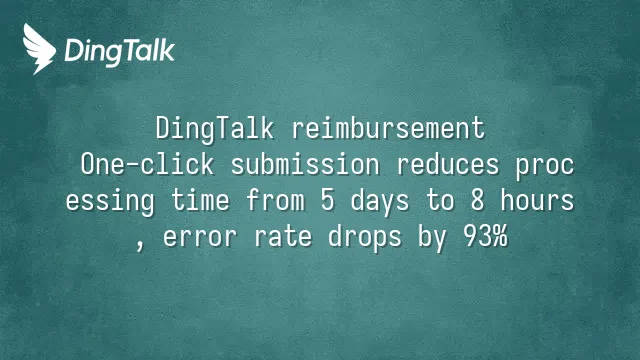

While you're still spending two hours manually entering invoices, verifying account codes, and chasing manager approvals, your competitors have already compressed their reimbursement cycle from five days to eight hours using "one-click submission" technology. DingTalk’s one-click submission isn’t just a simplified button—it's a decision-making system deeply integrating intelligent recognition, rule engines, and automated workflows.

OCR + AI recognition technology means over 90% of data is automatically extracted by the system, which scans both paper and electronic invoices in real time, accurately capturing 14 key details such as amount, date, and vendor name, drastically reducing human input errors.

Built-in intelligent rule engine ensures every expense is automatically matched to the correct accounting code and budget item, as the system interprets company-defined subsidy standards and travel tiers, preventing chaotic month-end adjustments.

Automated workflow eliminates the need for manual judgment in routing approvals—the system dynamically triggers the next review step based on predefined matrices, avoiding bottlenecks. After implementation at a multinational manufacturer, monthly processing volume increased 2.3 times while manual intervention dropped by 82%.

This is about more than saving time—it transforms finance roles from “data entry clerks” into “cost analysts.” With 70% of administrative time freed up, teams can focus on budget optimization and cash flow forecasting.

How Automation Enhances Transparency and Compliance

When reimbursement documents are trapped in emails and paper files, companies waste an average of 17 hours per month on duplicate reconciliations and face growing compliance risks. DingTalk’s one-click reimbursement breakthrough turns every expense into a traceable, tamper-proof digital trail, establishing financial transparency from the outset.

Complete audit trail records reduce internal audit preparation time by 60%, as all actions are instantly logged, meeting SOX internal control requirements for public companies and external audit needs.

Automatic anomaly detection prevents annual overspending by more than 12% (according to the 2024 Asia-Pacific Financial Control White Paper), thanks to built-in tax rules and GDPR-compliant frameworks that restrict access to designated approvers.

- Predefined rules block non-compliant claims, preventing policy violations

- End-to-end traceability supports compliance differences across multi-entity groups

- Dynamic approval matrices adapt to regional regulatory requirements

Financial transparency is no longer reactive—it's proactive defense. When every expenditure has context, justification, and control points, businesses shift from passive response to active governance—the key to lean financial operations.

Real Business Returns from One-Click Submission

After implementing DingTalk’s one-click reimbursement, a major retail enterprise reduced its processing cycle from 4.2 days to just 8 hours, with error rates dropping by 93%. This isn’t just improved efficiency—it’s a fundamental transformation in financial operations.

Staff time savings free up 5,000 working hours annually—equivalent to 2.5 full-time employees (FTEs) redirected to strategic planning—as automation eliminates repetitive administrative tasks.

Payment speed tripled directly improves supplier relationships and negotiation power, as faster cash flow cycles reduce short-term financing needs by over 18% (based on the 2024 Asia-Pacific Finance Automation Trends Report).

Employee satisfaction increased by 41%, reflecting recognition of greater management transparency, as past complaints and attrition risks due to delays have turned into positive feedback loops.

- Return on investment within six months: technology costs are fully offset by labor savings and reduced risk

- Replicable financial middleware capability: standardized processes support rapid expansion across regions

The real question isn't “Is it worth investing?” but “Can you afford to keep handling it manually?”

How Enterprises Can Deploy Quickly and Maximize Benefits

If your organization still spends several hours each week on manual reimbursement reviews and communication, then “one-click submission” is not merely a feature upgrade—it’s a pivotal shift in financial operations. Unautomated processes cost businesses an average of 17 work hours monthly, with error rates reaching 12%. This is exactly the reality DingTalk can transform within 30 days.

Transformation doesn’t require complex development—success hinges on a systematic five-step deployment:

1. Activate DingTalk Reimbursement module as the unified entry point

2. Set company-level rules (e.g., transportation allowance caps) so AI automatically assesses compliance

3. Integrate with accounting systems (e.g., Yonyou / Kingdee) to eliminate double data entry

4. Train employees via 5-minute micro-courses on uploading receipts via photo and tracking progress

5. Monitor success rate during the first two weeks and fine-tune OCR accuracy

Mandatory standardization increases automation rates from 60% to 98%, since only clear, complete, and glare-free electronic invoices ensure successful OCR recognition.

The true value lies in synergy—when reimbursement integrates with DingTalk attendance and travel booking,administrative time drops by 70%, and month-end closing finishes five days earlier. Start now, and within 30 days, transform your finance team from “form reviewers” into “strategic analysts.”

Stop letting paper receipts hold your capital and talent hostage. Activate DingTalk’s one-click reimbursement today and reclaim valuable time for what truly matters—strategic thinking, customer service, and business growth.

We dedicated to serving clients with professional DingTalk solutions. If you'd like to learn more about DingTalk platform applications, feel free to contact our online customer service or email at

Using DingTalk: Before & After

Before

- × Team Chaos: Team members are all busy with their own tasks, standards are inconsistent, and the more communication there is, the more chaotic things become, leading to decreased motivation.

- × Info Silos: Important information is scattered across WhatsApp/group chats, emails, Excel spreadsheets, and numerous apps, often resulting in lost, missed, or misdirected messages.

- × Manual Workflow: Tasks are still handled manually: approvals, scheduling, repair requests, store visits, and reports are all slow, hindering frontline responsiveness.

- × Admin Burden: Clocking in, leave requests, overtime, and payroll are handled in different systems or calculated using spreadsheets, leading to time-consuming statistics and errors.

After

- ✓ Unified Platform: By using a unified platform to bring people and tasks together, communication flows smoothly, collaboration improves, and turnover rates are more easily reduced.

- ✓ Official Channel: Information has an "official channel": whoever is entitled to see it can see it, it can be tracked and reviewed, and there's no fear of messages being skipped.

- ✓ Digital Agility: Processes run online: approvals are faster, tasks are clearer, and store/on-site feedback is more timely, directly improving overall efficiency.

- ✓ Automated HR: Clocking in, leave requests, and overtime are automatically summarized, and attendance reports can be exported with one click for easy payroll calculation.

Operate smarter, spend less

Streamline ops, reduce costs, and keep HQ and frontline in sync—all in one platform.

9.5x

Operational efficiency

72%

Cost savings

35%

Faster team syncs

Want to a Free Trial? Please book our Demo meeting with our AI specilist as below link:

https://www.dingtalk-global.com/contact

English

English

اللغة العربية

اللغة العربية  Bahasa Indonesia

Bahasa Indonesia  Bahasa Melayu

Bahasa Melayu  ภาษาไทย

ภาษาไทย  Tiếng Việt

Tiếng Việt  简体中文

简体中文